Topic

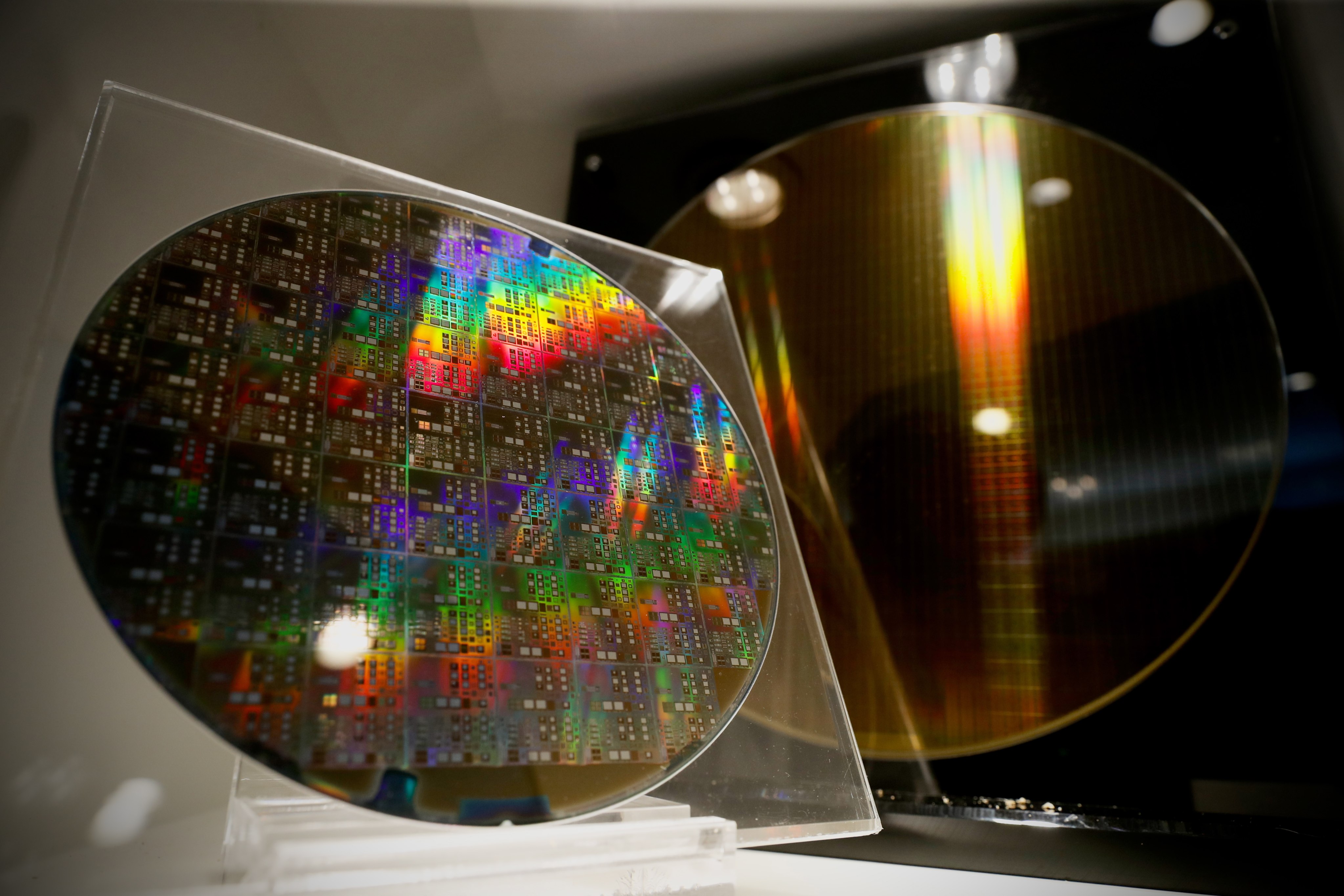

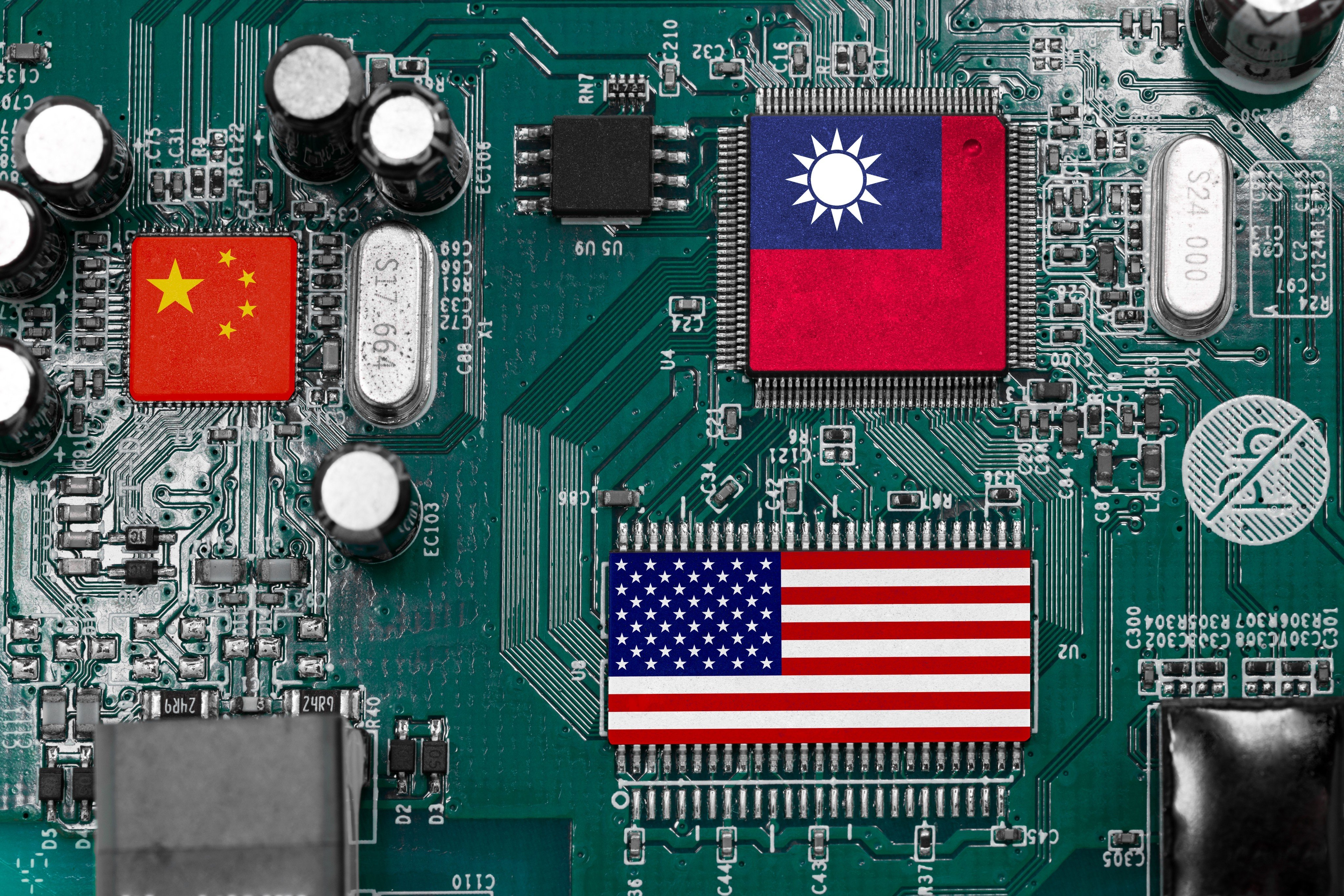

Taiwan Semiconductor Manufacturing Company (TSMC) is the world’s most valuable semiconductor company, the world’s largest independent semiconductor foundry, and continues to lead in global supply as well as research into new fabrication methods.

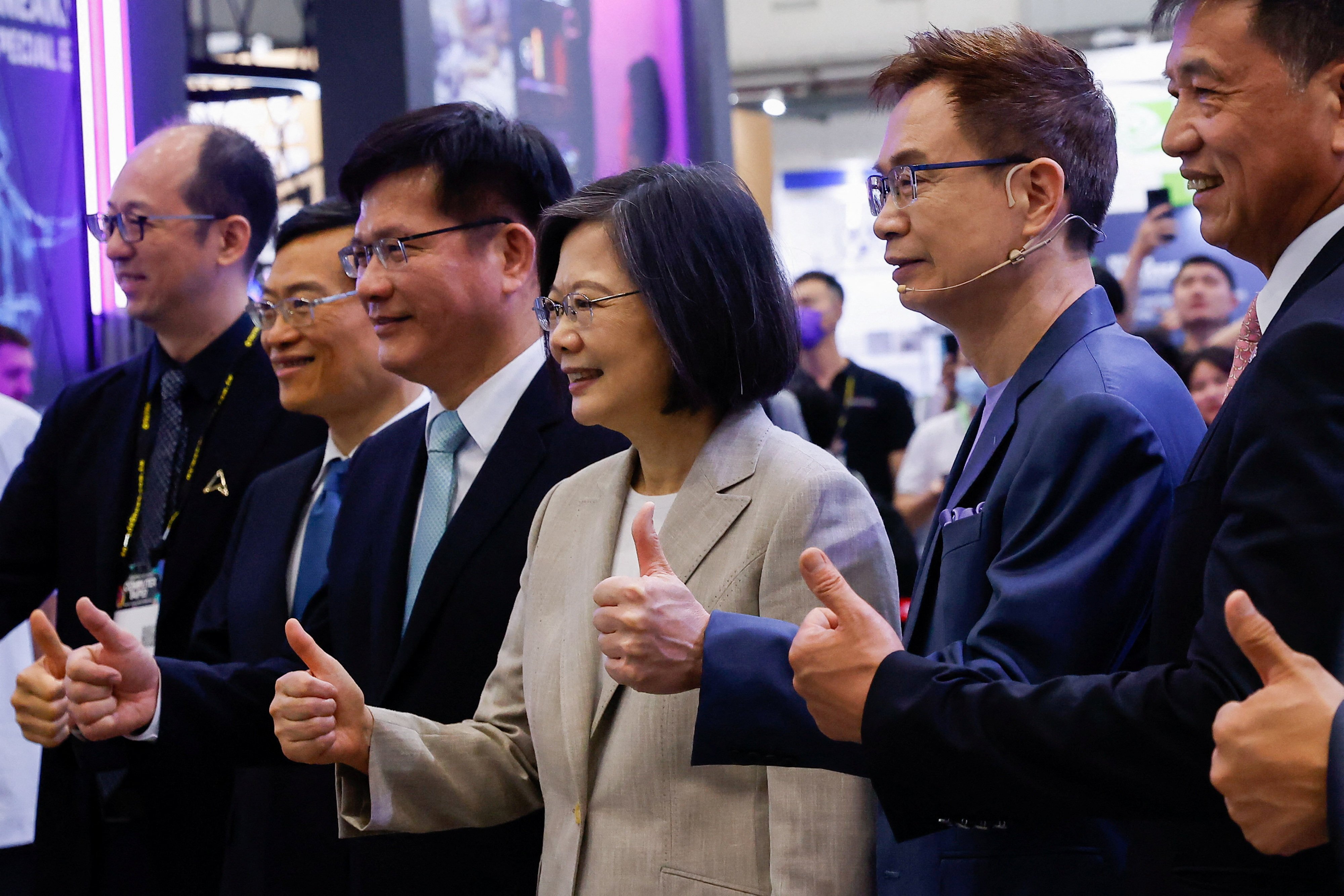

No thanks to Tsai, TSMC is waking up to the danger of Washington’s ‘friendshoring’ of its most advanced chip-making capabilities.

- Samsung will increase output in Pyeongtaek, South Korea, and Taylor, Texas, to shore up the foundry division, which makes chips for customers on a contract basis

- The company said its 2-nm process would improve performance by 12 per cent and power efficiency by 25 per cent compared to its most advanced offering today

The mammoth deal – which surprised many – makes sense amid growing global tension in the critical semiconductor sector, with other similar agreements likely, analysts say.

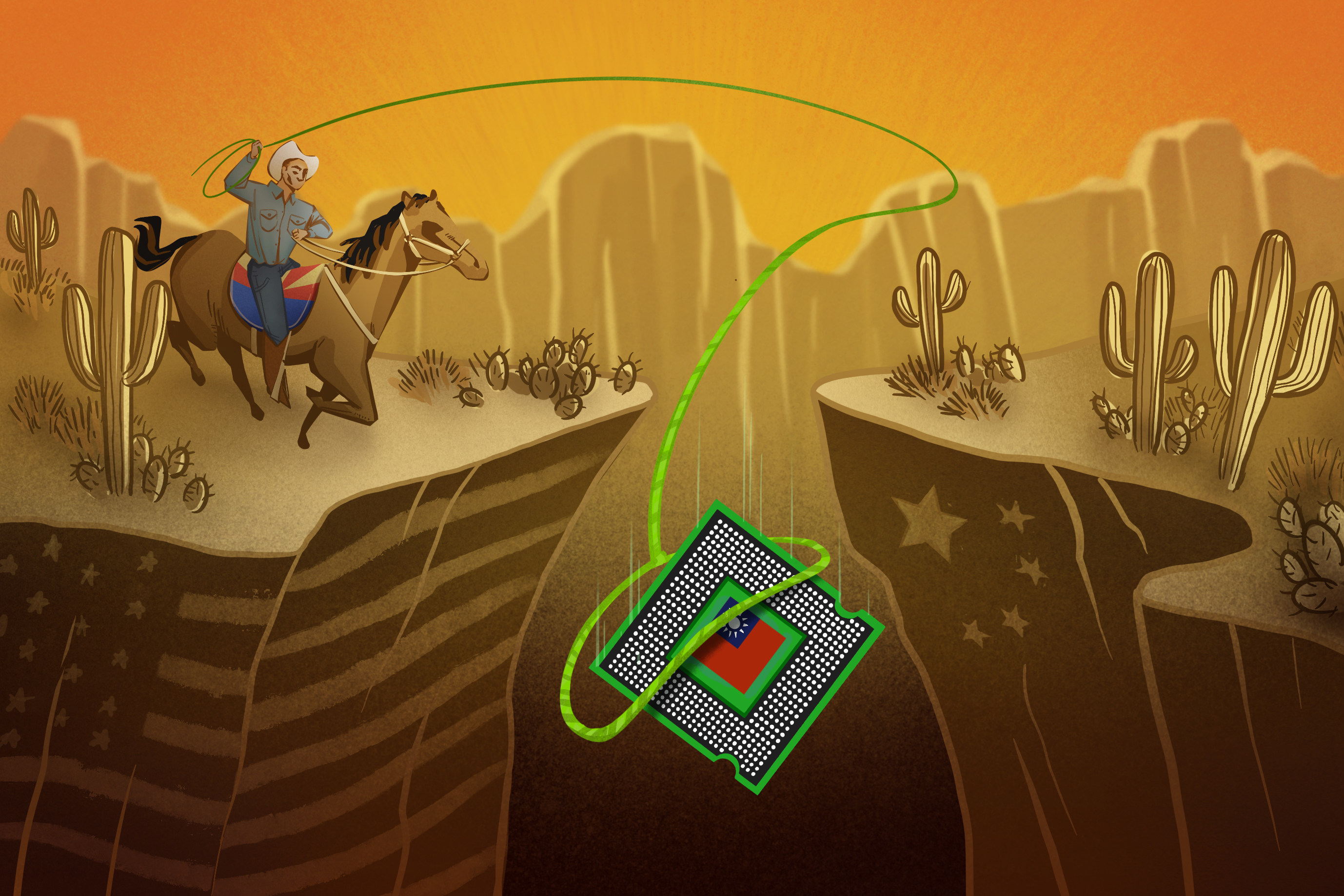

Arizona’s long-standing support for Taiwan, going back to the 1960s, underscores the increasing importance of subnational diplomacy for the self-ruled island.

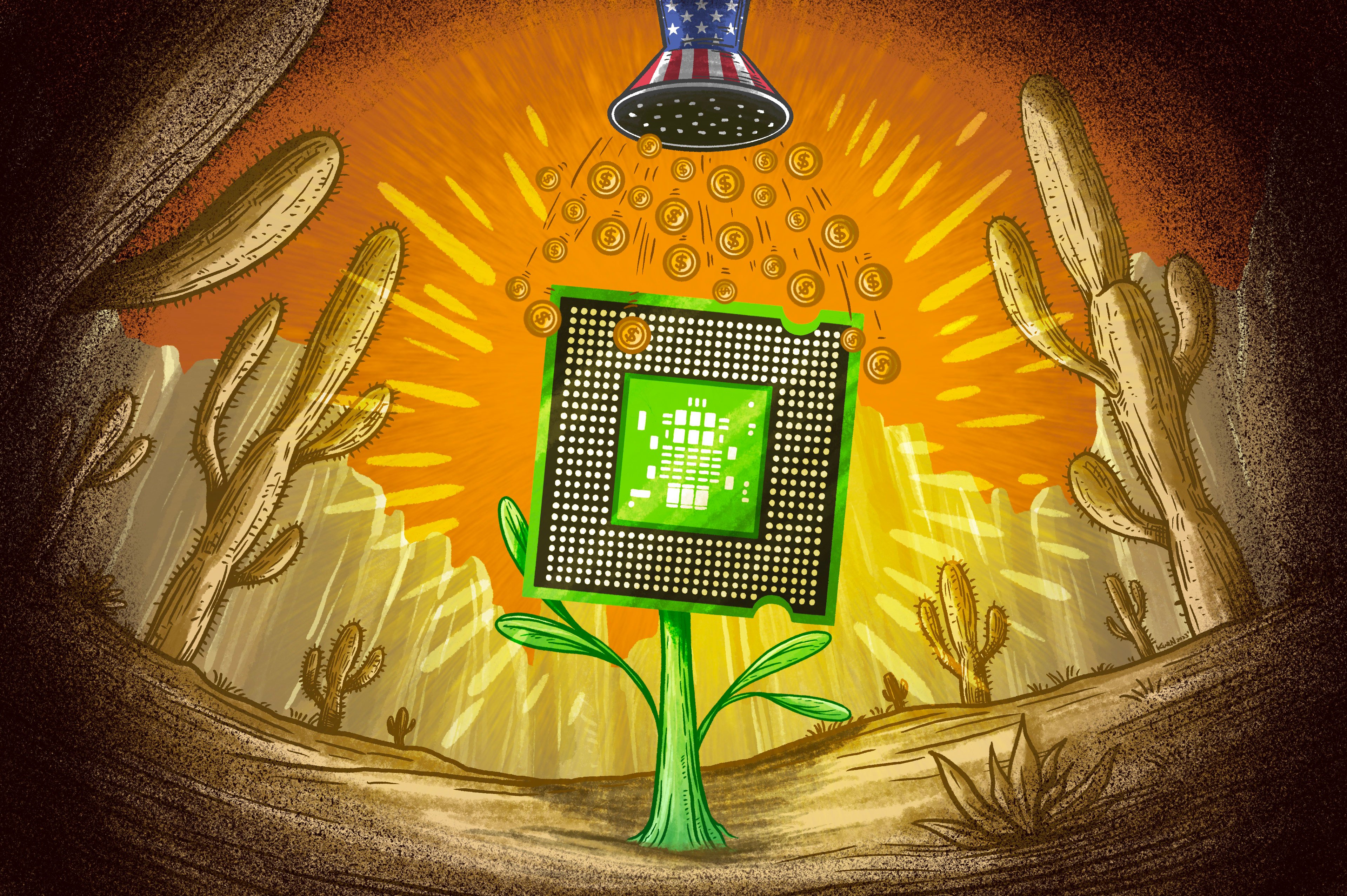

The race to build domestic semiconductor factories and sever dependency on overseas suppliers for these critical components is spurring a spending boom, and the biggest beneficiaries so far are the chip makers.

Intel sealed the agreement for a plant in Magdeburg on Monday at an event attended by CEO Pat Gelsinger and German Chancellor Olaf Scholz.

Intel and Israel reached a preliminary deal to expand manufacturing capacity in the country as the chip giant seeks to retake leadership of the industry.

Arizona’s strength in semiconductors helped it court TSMC, but the deal could not have happened without federal spending resulting from resurgent industrial policy.

Electronics contract manufacturer Luxshare, a major supplier of AirPods for Apple that has also won iPhone 15 orders, emerged as the assembler of the US tech giant’s Vision Pro mixed-reality headset, according to a bill of materials analysis.

While Washington wants Taiwan’s world-leading chip makers to come to the States and shun mainland China, doing so would open a big can of proverbial worms, according to Taiwanese insiders.

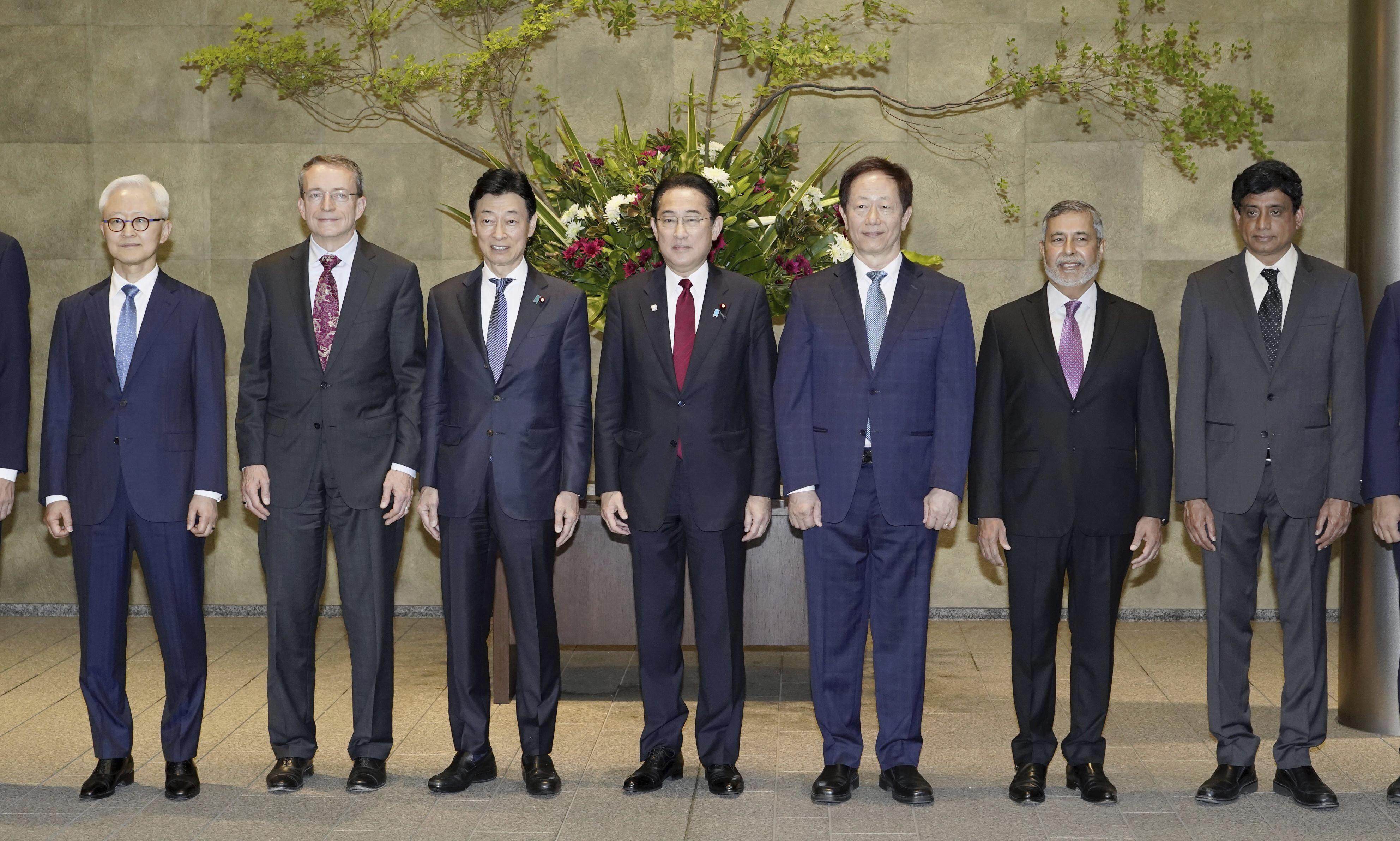

Tokyo plans to spend huge amounts on making its own advanced chips in collaboration with Taiwan Semiconductor Manufacturing Company, which is set to build its second Japanese plant.

TSMC’s capital expenditure should wind up closer to the bottom end of a previously forecast US$32 billion to US$36 billion range, company chairman Mark Liu said.

China’s semiconductor industry faces major pressure from Tokyo’s growing cooperation with the US on chip controls, prompting Beijing response.

US chip makers must ‘run very fast’ to stay ahead of Chinese competitors, Jensen Huang said during an industry expo in Taipei.

Taiwanese chip designer MediaTek said it will be using Arm’s latest tech innovation to boost the performance of next-generation smartphones.

The global tech hub’s recession-hit economy has had a tough go since last year, on weak demand for its exports, but an ‘optimistic forecast’ projects an end-of-year recovery.

The German government is in ongoing negotiations with the world’s largest contract chip maker, along with Bosch, NXP and Infineon, with support close to what Japan offered the firm.

Investors looking at chip giants like SK Hynix and TSMC are undeterred by expectations for a US recession and worsening Sino-American relations.

The host of this year’s Group of 7 summit is seeking a more prominent role in the global semiconductor value chain, as the US and its allies move to limit China’s role the future chip landscape.

A move by US senators to establish the Taiwan Tax Agreement Act might further isolate mainland Chinese firms from access to hi-tech semiconductors, in line with Washington’s efforts to stall China technologically.

Oppo, the fourth largest smartphone brand in the world, announced the move in a short statement on Friday after giving employees less than a day’s notice.

Gaw already manages US$3.8 billion of property assets in Japan and has begun a search on the western island of Kyushu.

Profits fell by 53.1 per cent year on year to US$267 million during the March quarter, while revenue dropped 20.6 per cent, the Shanghai-based firm said.

Greenpeace International, Stand.earth and 350 Asia said the world’s largest chip maker should target 100 per cent renewable energy by 2030.

Investment tycoon Warren Buffett said he is more comfortable with Berkshire Hathaway Inc deploying capital in Japan than Taiwan, reflecting the growing tensions between the United States and mainland China.

Derek Lin, a fund manager at Uni-President Asset Management, has refrained from buying more TSMC shares, citing softening return on equity.