Topic

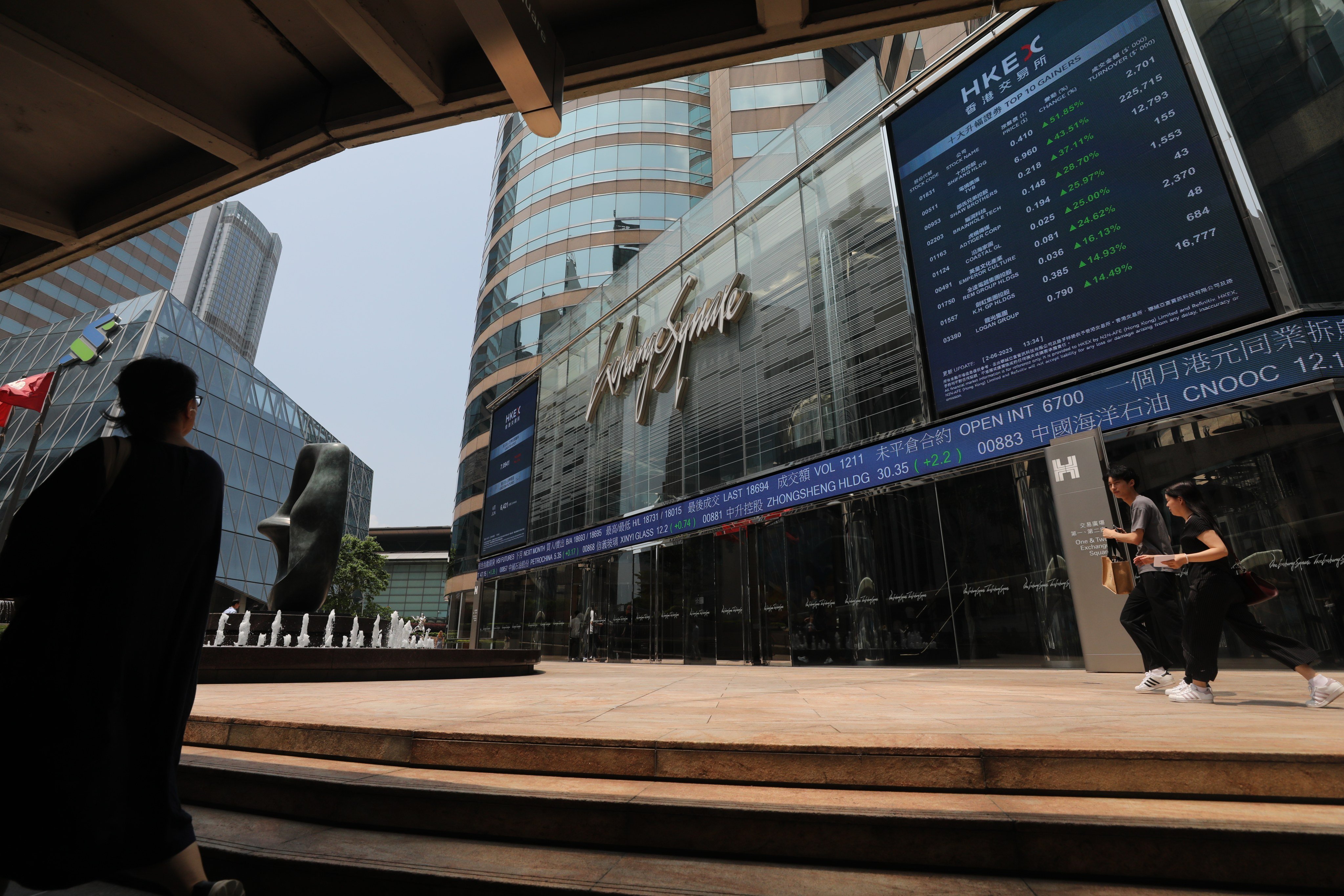

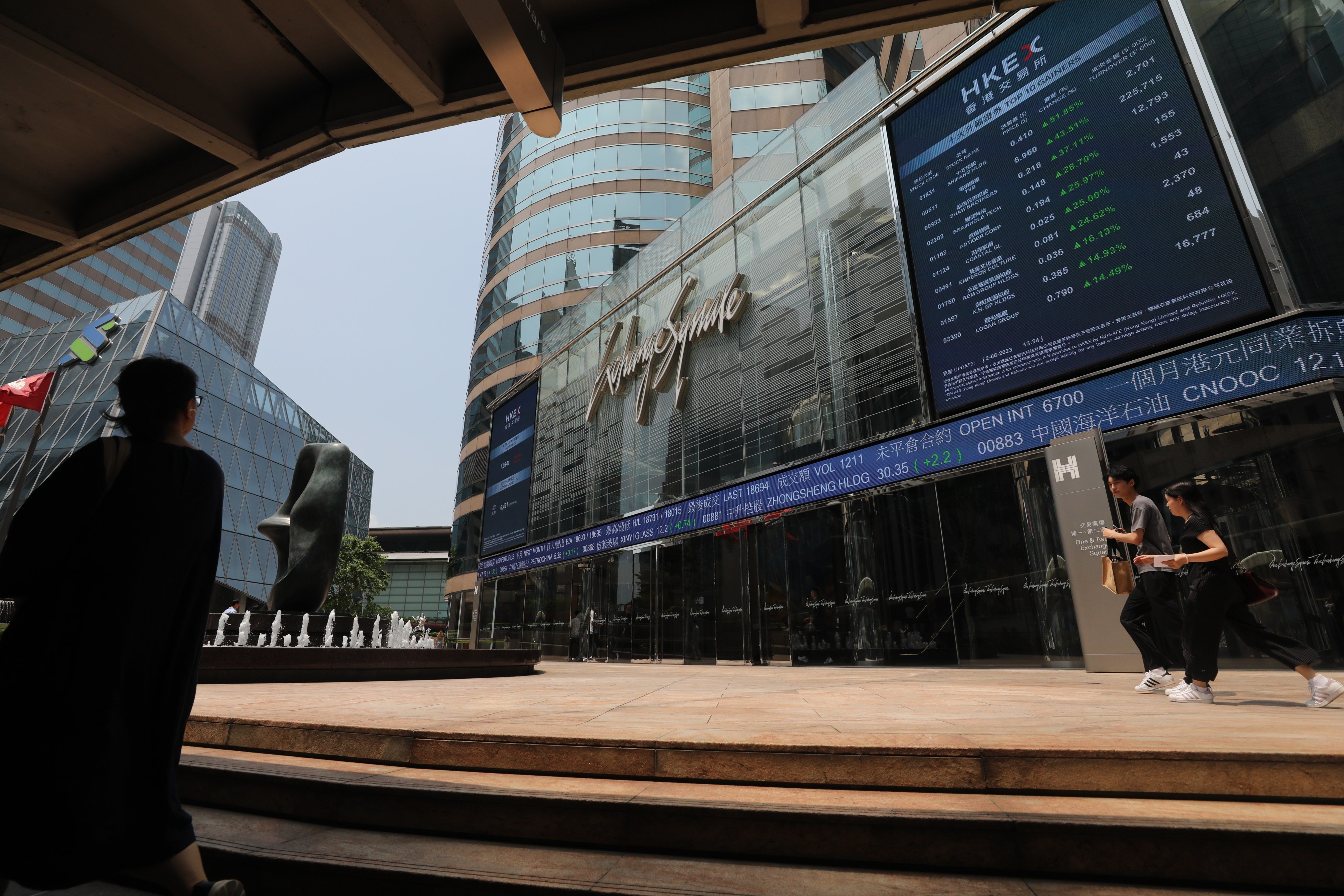

Latest news and analysis on initial public offerings (IPOs), with a particular focus on companies raising funds on the Hong Kong Stock Exchange.

New rules from the China Securities Regulatory Commission aim to bring transparency and end chaotic process that left such offerings mostly unregulated.

Hong Kong is once again in the limelight when it comes to IPOs but investors should remain cautious as the costs of the 2019 social unrest and Covid-19 curbs are still being counted.

More than just bragging rights, the health of the capital market can also underscore the city’s status as a global financial hub.

Primary listing in Hong Kong by tech giant will allow ordinary people to share in success of such companies and help drive nation’s development.

Openings in the US and Europe by city’s stock exchange aim to attract more initial public offerings and Chinese companies that face delisting on Wall Street.

City is a latecomer to special purpose acquisition companies, but this also means it has tougher measures in place to contain risk and shield market novices.

- China became a global IPO hotspot with a combined US$31.3 billion raised on the Shanghai, Shenzhen and Beijing exchanges in the six months to June

- The Chinese IPO market was rejuvenated after capital market reforms made it easier for companies to sell new shares

Hong Kong fell to ninth place in a global ranking of IPO venues, but analysts are optimistic the city can repeat last year’s performance and make a strong comeback in the second half of 2023.

Hong Kong Exchanges and Clearing, which runs Asia’s third largest stock market, has signed agreements with Beijing Stock Exchange and the government of Ningbo this week to explore ways to make it easier for start-ups and high-quality companies to list here, the bourse operator said on Thursday.

The management unit’s previous listing attempt – made in October 2022 – lapsed in April.

A new digital interface set to launch in October will cut the time between IPO pricing and commencement of trade from five business days to two, Hong Kong Exchanges and Clearing (HKEX) said in an announcement on Wednesday.

While Insilico has not announced an IPO timetable or amount, sources say the Hong Kong Science and Technology Park-based firm hopes to raise US$200 million.

Chinese solar silicon wafer manufacturer Longi Green Energy Technology, plans to raise as much as 20 billion yuan (US$2.8 billion) via the sale of global depository receipts (GDRs) in Switzerland, to fund an expansion as a growing list of companies diversify their funding sources away from US markets.

Amid US-China tensions, the government ‘urgently’ needs a Middle East strategy, the chairperson of the Chamber of Hong Kong Listed Companies says at the Post’s China Conference.

Carlyle-backed Adicon Clinical Laboratories joins Chinese peers in the biotech and healthcare sectors that are attempting to list despite a weak market sentiment.

Liquor distiller ZJLD Group is betting on its niche products to grow its market share and catch up with bigger rivals, after completing Hong Kong’s biggest stock offering in 2023.

Ma’s stint at the University of Tokyo underscores the Chinese tech billionaire’s return to public life as an educator and researcher, as he keeps an arm’s length from the vast business empire he created.

Jakarta-based J&T Express is reportedly considering a share sale in the city from US$500 million to US$1 billion as soon as this year.

The Shanghai Stock Exchange has approved the US$9.1 billion IPO of Syngenta Group, taking the Swiss agricultural giant a step closer to completing what could possibly be the world’s largest offering this year.

Bourse operator Hong Kong Exchanges and Clearing (HKEX) will continue to develop products and services to help the city become ‘the world’s leading green technology and green finance centre’ and an offshore yuan trading hub, says Financial Secretary.

Funds will mainly be used to develop the pharmaceuticals circulation business, for platform development and R&D.

The embattled cryptocurrency exchange may be deterred by a range of operational adjustments it must make to get licensed in the city, analysts say.

Dalian Wanda Group is ‘confident in defending’ against the freeze but faces liquidity concerns following repeated failures by its unit Zhuhai Wanda Commercial Management Group to get approval for a Hong Kong IPO.

PwC Hong Kong estimates that around 100 companies will list in Hong Kong in 2023, with total funds raised as high as US$21.7 billion, surpassing 2022’s totals but falling far short of 2021’s.

Shanghai-based Hozon follows up exports of 3,600 cars in March with another batch of 4,000 units recently, according to a statement on its WeChat account.

Bourse operator HKEX, which runs the third-largest stock market in Asia, plans to reform its second board which will allow SMEs and technology start-ups to raise funds.

China’s AI start-ups received a shot in the arm from the popularity of generative AI tech led by ChatGPT. Entrepreneurs like Mobvoi founder Li Zhifei are wasting no time in pursuing the next big thing.

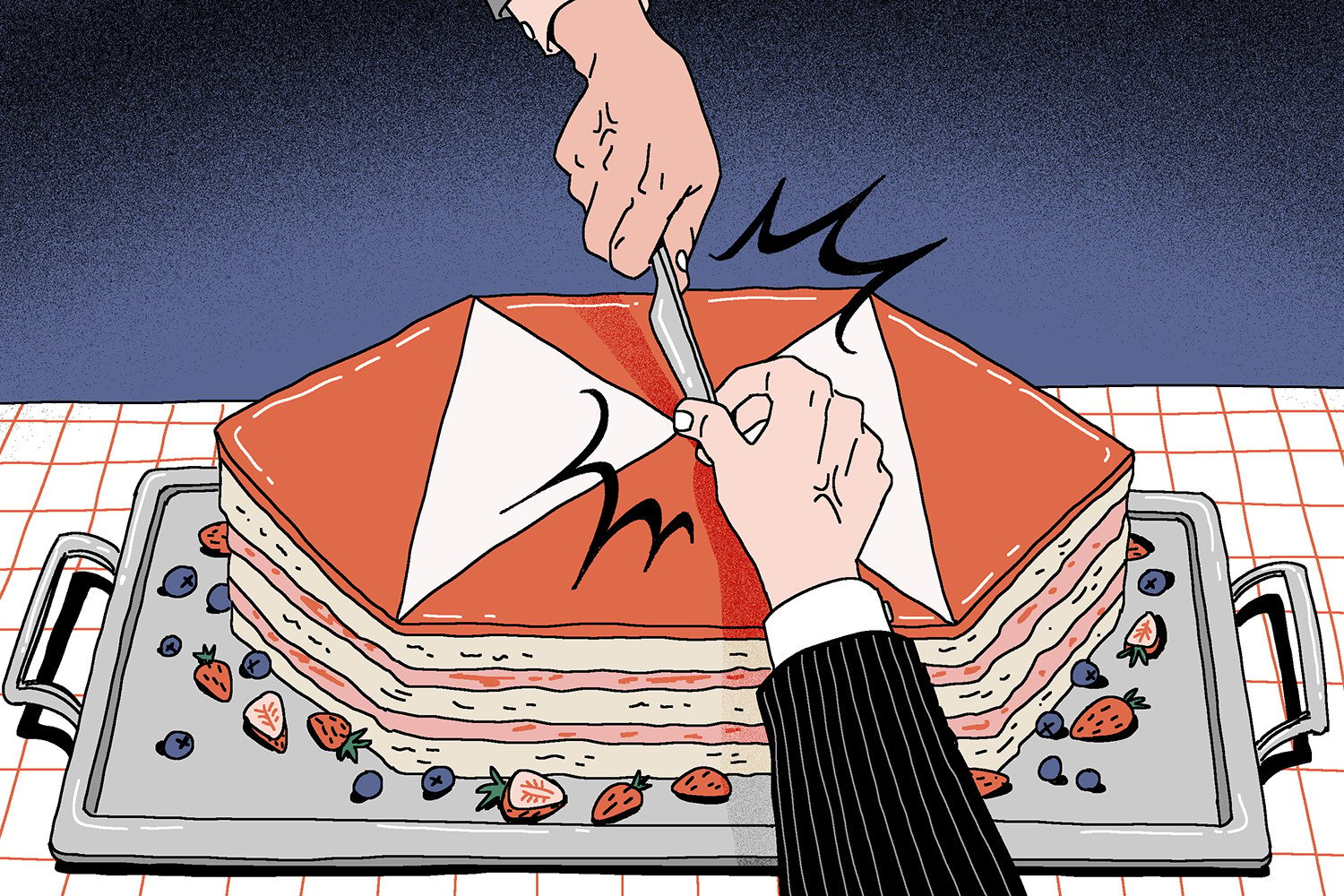

HSBC’s Asia operations are ‘motoring’ as the lender looks to future growth from its biggest revenue driver, but will the bank’s improved performance and promises of bigger dividend payout be enough to satisfy unhappy investors?

AI and electronics firm Mobvoi aims to raise up to US$300 million, while pharmaceutical company HighTide targets up to US$200 million amid a lacklustre year for IPOs in the city.

After raising US$39 million from its Nasdaq IPO in March, Xiao-I is ready to make its way to the world stage, founder and CEO Yuan Hui says.

Private equity and venture capital firms are hoping China and Asia will emerge as bright spots for the industry after a lacklustre couple of years, the China Private Equity Summit heard on Tuesday.

Dalian Wanda’s dollar bonds jumped to a new high on Monday after it said creditors of loans worth US$1.3 billion had not demanded early repayments following the failed IPO of unit Zhuhai Wanda.

Taiwanese chip designer MediaTek said it will be using Arm’s latest tech innovation to boost the performance of next-generation smartphones.

Micro Connect, an investment platform co-founded by Charles Li, the former boss of Hong Kong’s stock exchange is helping China’s small businesses raise funds from foreign capital. Here’s how it works.

That move by solid-state driver maker Memblaze reflect how Beijing’s actions against Micron could impact some local companies.

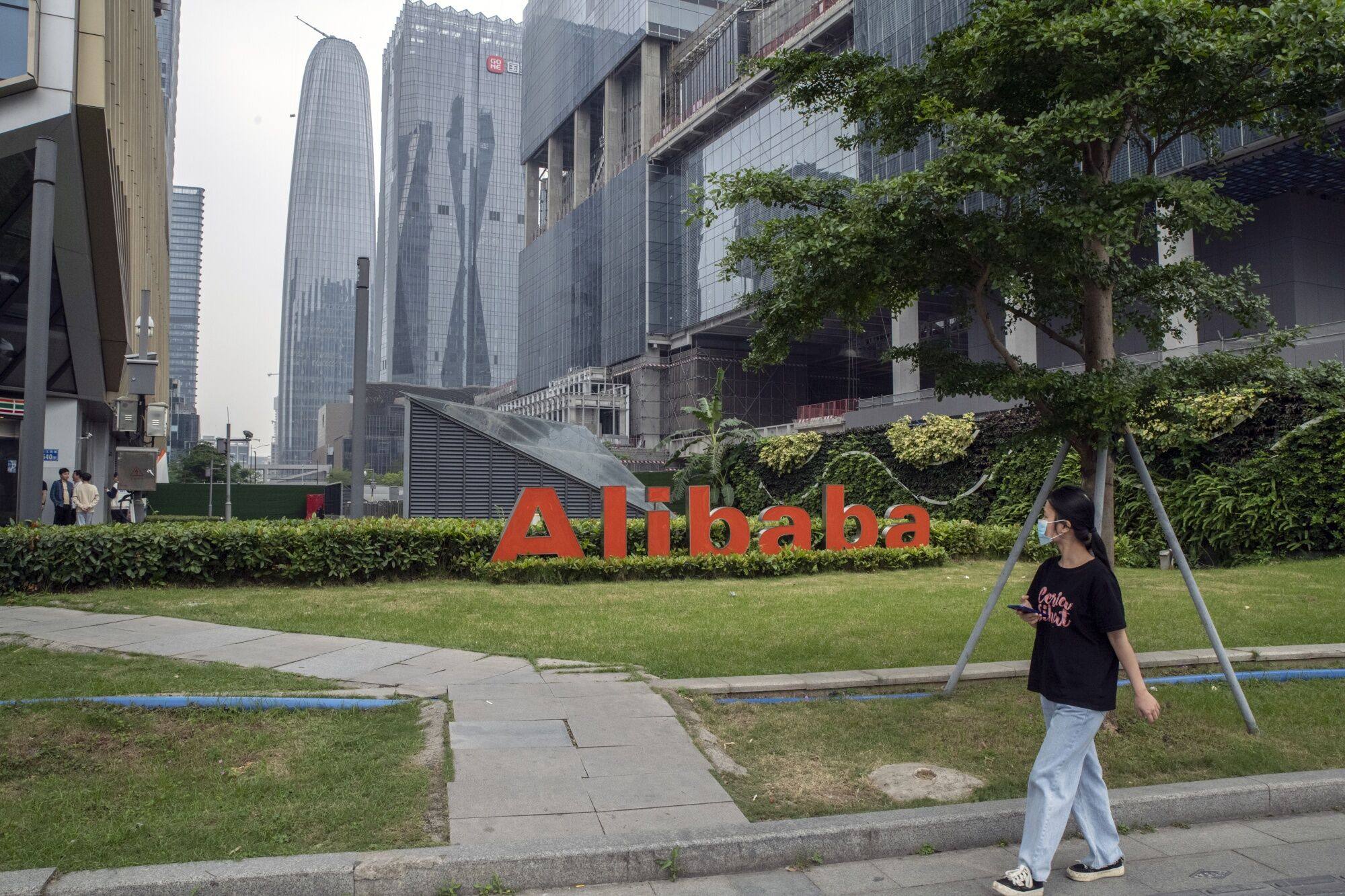

Alibaba’s statement follows reports that its cloud computing division is laying off about 1,000 workers ahead of an expected IPO.